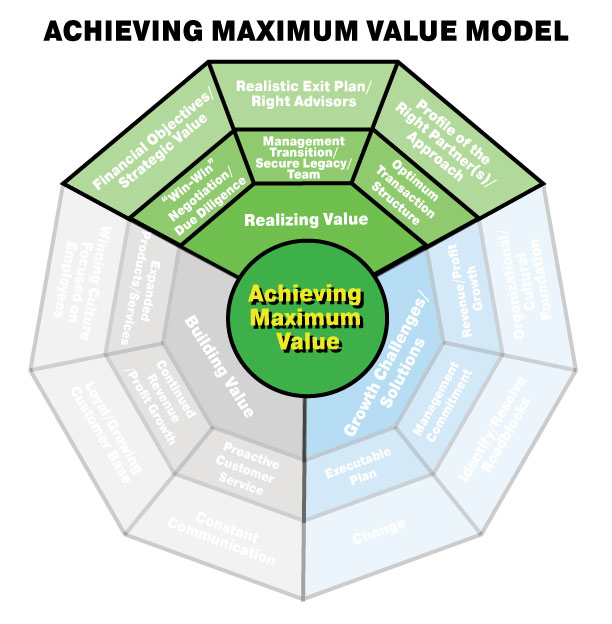

Realizing and Maximizing Value through Exit

Advisory Services

Review, Assessment and Plan

- Assistance with development of your specific financial objectives for an optimum exit and determination of what the potential strategic value of the company can be with the right partner(s).

- Assistance with the development of the narrative and associated financials, that properly packages and positions the company for a transaction that maximizes the company’s strategic value.

- Helping you develop a transition/succession plan that does not rely on your presence and provides your management team with comfort for their future.

- Helping you develop a profile of your ideal partner and deal structure.

Execution/Ongoing Advisory

- Developing and directing an efficient process that targets and finds those partners that are not only a good financial fit but fit best with your culture.

- Developing the right transaction structure for you and your team, that maximizes your overall return.

- Understanding and communicating with and to your team how the operation will function in the “brave new world.”

- Assistance with and managing the closing transaction with other key advisors (like legal and accounting) that maximizes value for you and your team and is a “win-win” transaction for you and your new partner.